This Is Why You’re Missing Out

Your money should be working hard for you. If you are getting great returns on your investments you can relax knowing that one day you will be able to stop working and live well off your investment income.

The sad truth is that this is a reality for a very few people.

Why is that?

After all, stock markets give investors amazing rates-of-return and are easy to access.

Yes, shares go up and down, but the long term returns are very good.

From 2012 to 2021 the S&P 500 returned nearly 15% per annum. A lump sum investment made at the beginning of 2021 had quadrupled in value by the end of 2021. An investment of 1,000 a month was worth a quarter of a million ten years later.

Over the very long-term (the last century), the rate–of-return on S&P 500 is around 10.9% per annum. At this rate 600 a month turns into more than half a million over 20 years, and…

600 a month becomes more than

1,500,000

over 30 years

Unfortunately, the average investor – and those that hand their financial well-being to financial advisors – are most probably not getting returns anywhere near these spectacular results.

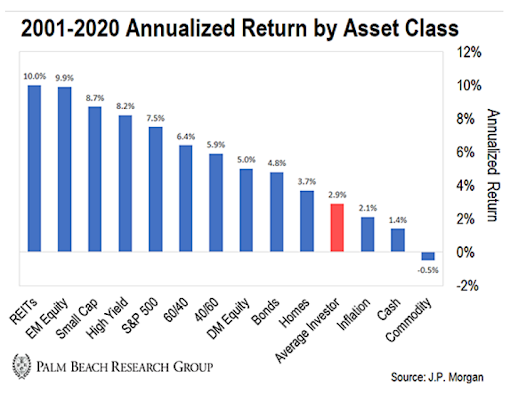

Look at the graph below.*

You’ll see that over the past two decades the average retail investor has done dismally. They’ve done worse than just about everything else.

WTF?

Why is the average investor not even managing to get above 6% per annum when stock markets, decade after decade, deliver outstanding rates-of-return?

One word…

EMOTIONS

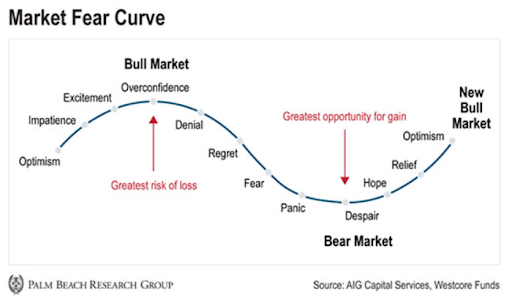

The emotional rollercoaster ride shakes many investors out of the market and destroys their chances of achieving financial freedom.

On the emotional roller coaster the average investor destroys wealth by…

- buying when the market is high

- selling when the market is low

- staying out of the market during bull runs

- staying in the market during bear runs

But why would anyone do these things, you may ask?

Why would anyone be so STOOOOOOOPID.

It’s actually easier than you think to be STOOOOOOOPID.

It’s because we are emotional creatures!

➤ This is what happens when investors let their emotions drive their wealth bus…

Fear and greed become the prevailing forces.

Fear and greed are terrible drivers – they will either drive you over a cliff or freeze at the wheel and prevent you from getting anywhere.

Not a great way to get to freedom.

In the Masterclass Series on How to Pick Great Stocks and Increase Your Portfolio Returns, Nic Oldert and I show you how to conquer the market fear curve by protecting yourself from fear and greed, and by having a clear strategy to achieve above-average returns and get to your financial freedom faster.

We share how to use technical and fundamental analysis to help you pick the stocks that are likely to outperform the market – and how to invest in these stocks cost effectively.

You add these “conviction” stocks to a base of solid index trackers – which will already ensure you get market returns. As you can see above, average market returns beat all the returns achieved by typical investors – who have no clear strategy and do things that erode wealth.

You add a few selected conviction stocks to your index tracker base to “move the needle” and get a small increase in your annual rate-of-return.

A small increase in rate-of-return equals

a big increase in your investment results

Compounded annually, a 2% increase in your average portfolio return makes an exponential difference to the amount of money you end up with. Over 30 years, that difference could be 70% or more!

If you start your investment journey with 10,000 and you know one path will grow that amount to 174,000 and another will grow the same amount to 300,000… which path will you take?

That seems like a silly question – obviously the path to 300,000!

But to be on that path you cannot do what the average investor does.

You must tame your fear and greed monsters, have a robust and proven investing strategy – and then you must stick to your strategy.

It’s not complicated, but if you don’t know what it is, it’s highly likely you’ll let fear and greed drive you around and get nowhere.

If you don’t have your strategy firmly anchored in your life, and you aren’t confident that you are getting your money working as hard as it should be, you can take a look at the Stock Investing Masterclass Series.

So how do you tame the fear and greed monsters

that drive the emotional side of investing?

The best way to do this is to avoid the emotional roller coaster completely by applying these four principles in your investing life.

They will help you protect your money from you, improve your returns, and get you to your freedom number.

➤ Diversify your assets

The secret to building wealth (and keeping it!) is diversification. This is why I go on and on about building a solid base of broad market index trackers which give you fabulous diversification across markets and geographic regions.

Not only does diversification lead to better returns, it also lowers risk. Numerous studies show that asset allocation accounts for 90% or more of portfolio risk-reduction.

➤ Stop listening to the news and short term noise

The market’s short-term direction is unknowable. The daily and weekly ups and downs are just reactionary, they tell us nothing about the fundamentals of the markets and the companies that make up the market.

In addition, no one has a crystal ball.

Anyone who pretends to know where the market is going short term is a very big liar!

The so-called experts that do this full time (and get paid eye-watering amounts to do so) get it wrong more often than they get it right. That’s why we don’t bother with actively managed funds (another tip to getting your money working for you and not for the financial industry!).

Tune out the noise, don’t get sidetracked by the drama-loving newsfeeds. Stay focused on the big picture and stick to your strategy.

➤ Set Up An Automated Investing Plan

Automatic investing simply means investing money regularly.

Have a look at my video on Boring is Beautiful which is all about your base investment strategy. This is the simple strategy of investing in a handful of broad market index trackers which you contribute to consistently. If you haven’t yet set this up, get a copy of The Wealth Chef book and put this in place in your life before you consider doing anything else.

➤ Be consistent – have a strategy, make a plan and stick to it

Other than annual adjustments and periodic rebalancing during your BIG MONEY DATE, you shouldn’t deviate much from your investing strategy and implementation plan.

If you have a life-changing event, reevaluate your plan at that time.

But following your strategy and sticking to your implementation plan will keep you from making emotional investment decisions.

Challenge Yourself Today

I know these four principles may seem daunting. You may be thinking, “Easier said than done, Ann.”

So that’s why I challenge you to put these steps into action.

It’s not that hard to train yourself to become a great Wealth Chef and get your money working for you. But you do need to know the recipes – and then you need to implement them.

Start by diversifying your assets at the base of your investment pyramid with a simple portfolio of broad base index trackers.

Set up a regular investment plan where you commit to investing in these monthly through a direct debit / standing order into your online broker account.

The more you can automate your wealth creation, the more successful it will be.

Once you’re invested, ignore the day-to-day noise in the media.

Once this is in place, add a set of conviction stocks on top of your index tracker base. The purpose of these stocks is to increase your overall rate-of-return and accelerate your financial freedom.

If you follow this simple game plan, you won’t let fear shake you out of the market at the wrong time. And you can ride your investments to the top.

Before you know it, not only will you outperform the average investor… you’ll also significantly move the needle on your net worth.

Get yourself a copy of The Wealth Chef book to learn how to get your base investments in place and a look at the Stock Picking Masterclass Series to learn how to select your high performing stocks to add on top of your base to increase your returns.

➤ How much is the 300,000 path worth to you?

Are you prepared to take some time to learn so you can live free?

If you’re not prepared to put a little in to get a lot out, that’s totally your choice. Please just make that choice consciously and understand the consequence of never learning how to get your money working for you.

I hope you choose freedom.

Big love

Ann

*This webpage is a great place to check S&P 500 rates-of-return over different periods. You’ll see that start and end dates can make a big difference – just one of the things we talk about in the Stock Picking Masterclass Series.